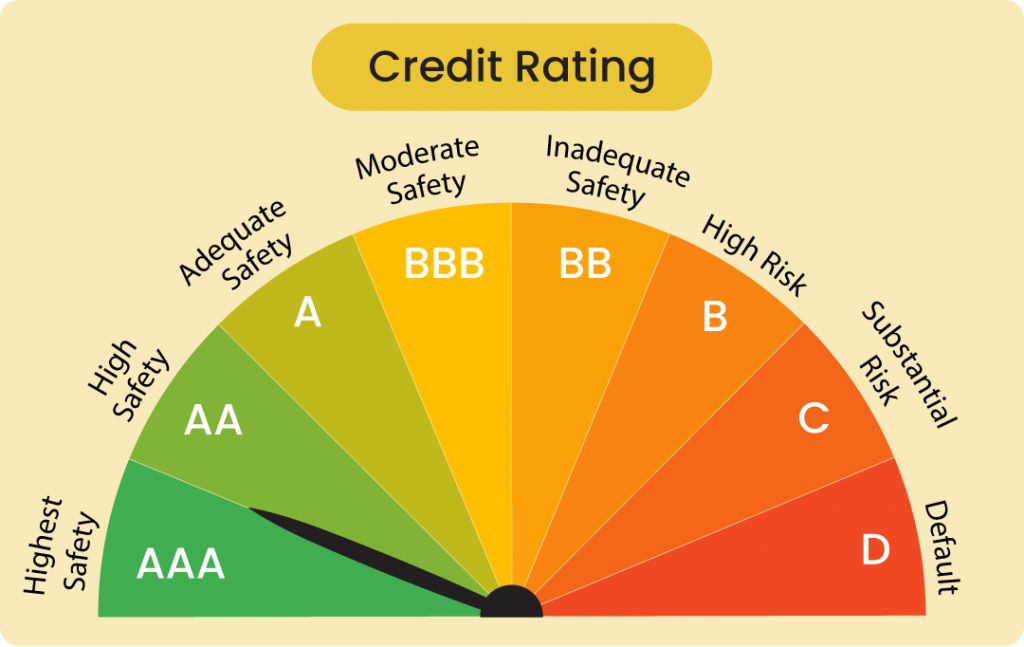

In today’s fast-paced financial world, having a solid credit rating isn’t just a number — it’s a vital asset. Whether you’re running a startup, a small to medium-sized enterprise, or a large corporation, your credit rating can significantly influence your growth, scalability, and ability to secure funding.

At Ratinova, we’re dedicated to helping businesses grasp and enhance their credit ratings through expert advice and strategic financial insights. Here’s why this is so important:

- Better Access to Capital – A strong credit rating is like a green light for banks and financial institutions. It boosts your chances of securing loans, working capital, and other credit options at more favorable interest rates.

- Lower Cost of Borrowing – When you have a robust rating, you’re viewed as a low-risk borrower, which means you can negotiate better terms and lower interest rates. This can greatly reduce your capital costs, allowing you to invest more in growth opportunities.

- Builds Investor Confidence -Investors often see credit ratings as a reflection of financial health and governance standards. A solid rating fosters trust and transparency, making it easier to attract equity investors or partners for future fundraising rounds.

- Competitive Advantage in the Market – A good credit rating can set your business apart from the competition. It distinguishes you from rivals with poor or no ratings, especially when you’re bidding for government contracts or large corporate projects.

- Smooth Supplier & Vendor Relationships – Suppliers are more inclined to offer favorable credit terms to businesses with high ratings. This not only improves cash flow but also strengthens your partnerships within the supply chain — a crucial asset for scaling operations.

A credit rating goes beyond mere numbers it showcases your company’s governance, financial discipline, and transparency. A higher rating sends a positive message to the market, stakeholders, and regulators.

At Ratinova, our credit rating advisory services help you identify gaps, improve financial standing, and present a stronger case to rating agencies.

Leave a Reply