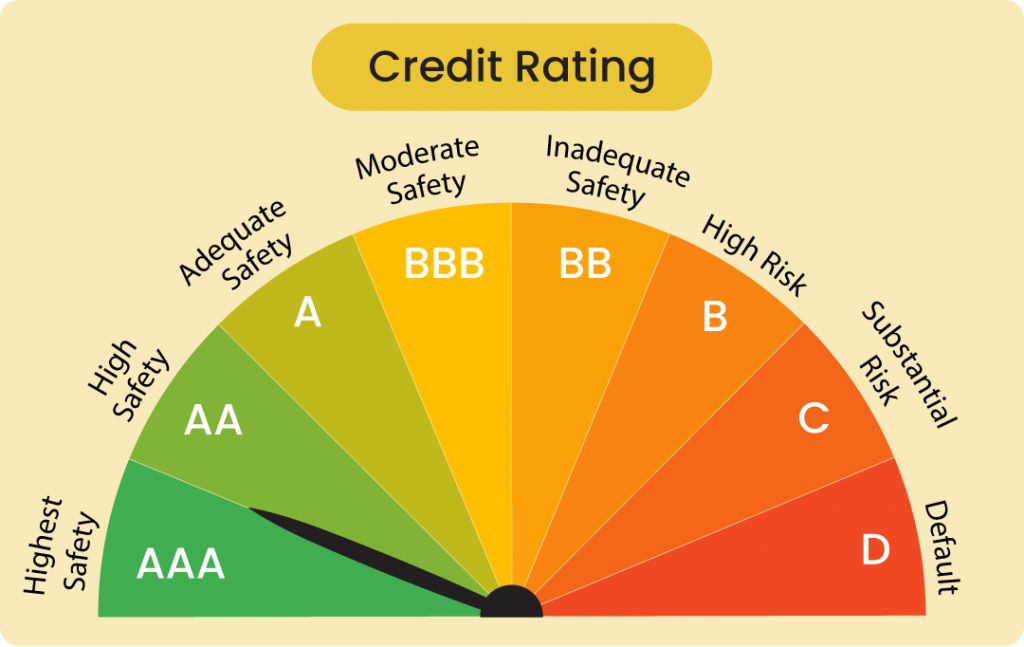

Access to capital and a company’s financial reputation are significantly influenced by its credit rating. Knowing the main elements that affect your credit rating will help you stay organized and prevent surprises when you’re applying for a bank loan rating, FD rating, or IPO planning.

At Ratinova, we provide strategic advice and actionable insights to help businesses enhance their rating profiles. The top 5 elements that have a major influence on your credit score are listed below.

- Financial Performance and Key Ratios – Key Ratios and Financial Performance Your financial statements form the foundation of any credit rating. Rating agencies pay close attention to metrics such as cash flows, operating margins, net profit trends, and your debt-to-equity ratio. A business demonstrates sound financial management and repayment capacity when it continuously reports healthy profits and keeps a healthy liquidity position. Maintaining control over financial ratios helps build trust in your company’s capacity to pay off debt. More significantly, they show long-term viability, which can improve your credit rating in the marketplace.

- Industry Risk and Market Dynamics – Market dynamics and industry risk The risk profile associated with your company is largely determined by the industry in which you operate. Generally speaking, riskier industries are those with high volatility, unclear regulations, or frequent changes in demand. However, companies in industries that are expanding and stable tend to be rated higher. Rating agencies also assess your company’s industry resilience. For instance, a company’s robust internal systems, clientele, or diversification tactics may allow it to maintain a high rating even though it has a significant presence in a high-risk industry.

- Corporate Governance and Management Quality – Quality of Management and Corporate Governance Agencies place a lot of importance on the “people factor” the management beyond the numbers. Building credit trustworthiness is greatly aided by ethical behavior, transparent leadership, and a well-organized governance model. This covers responsible decision-making procedures, audit frameworks, and independent board representation. On the other hand, even though the financials seem solid on paper, poor management or frequent leadership changes can raise concerns. Consequently, a favorable rating outlook depends on upholding sound governance.

- Capital Structure and Funding Sources – The way your company is financed is also important. Important areas of evaluation include a clear capital deployment plan, manageable repayment schedules, and a balanced mix of debt and equity. Your credit score may suffer if you rely too heavily on debt or take out short-term loans. A capital structure that promotes long-term growth without escalating financial vulnerability is what agencies seek. A carefully considered funding plan can greatly increase your creditworthiness in the eyes of investors and lenders

- Business Model and Competitive Strength – A business’s credit profile improves when the model is clearly defined, the market position is strong, and there is revenue diversification. Agencies analyze the customer demographics, their willingness to pay, growth potential, and competitive dynamics for marketing strategies. A business which has a strong foothold in multiple markets is likely to be rated higher than a company utilizing a few contracts or markets as its focal point, owing to greater revenue certainty.

Credit ratings are not built overnight they are earned through consistent performance, ethical governance, and strategic financial planning.

At Ratinova, we help businesses understand where they stand and how they can improve their creditworthiness with smart, actionable advisory.

Looking to boost your credit rating and unlock better financial opportunities?